Wealthify doesn't support your browser

We're showing you this message because we've detected that you're using an unsupported browser which could prevent you from accessing certain features. An update is not required, but it is strongly recommended to improve your browsing experience. Find out more about which browsers we support

Clear, Honest Personal Pensions

No jargon or complexity, just clear fees and investment styles to suit your needs. Plus, an instant 25% top up.

Plan your Financial Future

Wealthify’s Personal Pension is a great way to save for your long term goals. Use it to supplement your workplace pension, or transfer your existing pots to us to help your money work harder.

Use our Pension Calculator to see what your pot could be worth – just choose how much to contribute and pick an investment style that suits you. You can even choose an ethical pension if it better fits your values.

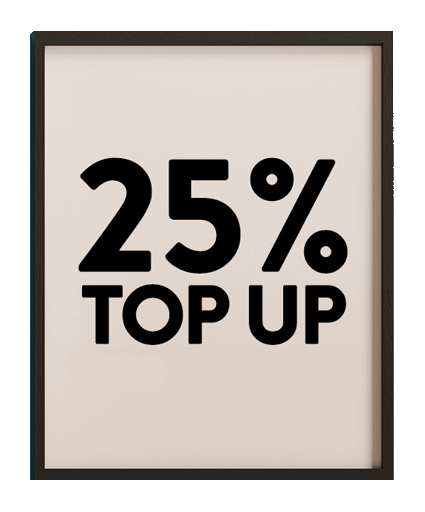

Instant 25% Top Up

Effortlessly grow your pension with an instant 25% tax relief top up - meaning every £800 invested in a pension is worth £1000 for a basic rate tax payer.

We automatically calculate the top up and add it to your investment, so there’s no need to chase HMRC!

Try it out

Pension Calculator

Want a better idea of what your pension could pay? Our calculator can give you an idea of how much you might want to save for your retirement.

Let us know how much is in your pension, when you're planning to retire, and how much you regularly contribute. The calculator will apply our projected investment performance and give you an idea of how much your pension might pay.

Calculate your savings pot nowFree Pension Guide

Not all personal pensions are the same, so we’ve created this useful guide to give you information on:

- What a Self Invested Personal Pension (SIPP) is

- How the 25% tax relief top up works

- How a SIPP differs from a workplace pension

- Reasons for consolidating pensions

This guide doesn't offer personal advice, speak to a financial adviser if you're unsure about whether investing is right for you.

Transfer in 3 easy steps

Tell us about your pensions

Tell us a few details about your pensions, including a reference number and recent value.

We manage your transfer

We’ll talk to your provider and start the transfer. This usually takes 2-6 weeks.

We invest and optimise

We'll monitor your Plan 365 days a year, adjusting it to stay on track.

Wealthify Customer Reviews

EARN £50-£500 CASHBACK WHEN YOU JOIN WEALTHIFY!

How do SIPPs (Self Invested Personal Pension) work and are they right for me?

ISAs and SIPPs: what is the difference? And which should you invest your money in?

How pension tax relief works and how to claim it

Self-Employed - How to make the most of your pension

What are the benefits of long-term investing?

5 things you need to know about Diversification

5 frequently asked questions about ethical investing

Where should I invest my money?

Learn more about our Pension

-

What is a SIPP?

-

Wealthify is offering a Self-Invested Personal Pension, or SIPP, which is a pension you personally set up and contribute to. It is separate to a workplace pension or the state government-funded pension.

A personal pension is a great way to complement your workplace pensions by having more flexibility over how you contribute and invest.

That means, instead of being enlisted in whichever pension your workplace is offering, you have a greater choice of investments. Pick a level of risk that you’re comfortable with, choose whether you want ethical investments and decide how much you want to pay.

Plus, you’ll get a 25% tax-relief top up on each contribution up to a total contribution limit of £48,000 (which becomes £60,000 with the £12,000 tax relief) or 100% of your earnings, whichever is lower. That means if you add £800 to your personal pension, tax relief will take this amount up to £1000, and best of all, you don’t have to do a thing. We’ll add this tax relief to your account automatically, so you don’t have to wait for HMRC – giving you 25% more to invest.

-

How much tax relief could I get?

-

Wealthify automatically adds the 25% top up when you make a personal contribution to your pension and only if you ticked the box to state your eligibility for tax relief when you opened the SIPP. So, if you personally pay in £800, the government adds another £200, making the total £1000. However, if you’re a higher-rate taxpayer, you may be entitled to more, in which case you will need to contact HRMC to be able to access higher-rate tax relief. This will need to be submitted on your annual tax return.

-

Can my employer pay into my Wealthify Pension?

-

Not at the moment, but it’s something we’re working on. Once we’ve got it up and running, we’ll let you know!

-

How do I transfer a pension to Wealthify?

-

Transferring your old pensions is easier than you might think – all we need to know is who your old providers are, reference numbers , an estimated value, and your permission to get in touch with your old providers regarding your pensions. You can usually find this information on your latest pension statement. We’ll do the rest and consolidate them into your Wealthify Pension.

If you’re an existing customer, simply head to your Dashboard and use the ‘transfer in’ button on your home screen.

-

When can I access the money in my pension?

-

You can access your pension when you turn 55 (rising to 57 in 2028), and are able to withdraw 25% of the total amount tax-free. However, you do not have to take the remainder of pension then. If you’re still working, for example, you can leave the money in your pension – and continue to contribute – until you retire.